The automation marketplace proved its resilience again in 2021 and returned to pre-pandemic levels. Despite advances in project engineering that reduced cycle times, automation projects in general are still long-cycle projects, and the overall market for systems took longer to recover than some of the more product-oriented and discrete automation businesses. Maintenance, repair and operations (MRO) and maintenance business recovers before the project business.

During “normal” times, which seem like a distant memory, the automation market has been a stalwart performer, steadily growing at moderate, single-digit rates. The demand for automation products, applications and services is a relative constant, even during times of recession. However, even the stalwarts were battered by the pandemic. Workers got sick, supply chains became frozen, silicon got scarce, oil prices went negative, and the entire market contracted in a manner not seen since the 2007-08 subprime mortgage crisis.

Headed for global recession?

Plus, now that we’ve overcome the COVID-19 pandemic of 2020 in just a year, warning bells are sounding for a global recession. Even if we don’t have a recession, it seems overall economic growth will slow in 2022, with the International Monetary Fund (IMF) estimating global economic growth will slow from 6.1% in 2021 to 3.2% in 2022. Even ARC’s own macroeconomic analysis predicts overall growth will slow in 2022, going back to more normal, pre-pandemic levels after an unusually strong, latter-half performance at the end of last year.

While global markets continue to be affected by the war in Ukraine, supply chain issues, silicon shortages and high prices for raw materials, ARC doesn’t expect the automation market to enter recession through the end of 2022 and beyond. While we expect growth to slow somewhat in 2022, capital expenditures by end users remained on a strong path into the first half of 2022. Industries like food and pharmaceuticals are performing well, with increasing initiatives for nations to become more autonomous in pharmaceutical production. Machine builders are also experiencing strong demand, as are manufacturers of semiconductors and electronics.

The automotive industry continues to grow, albeit at a slower pace due to parts and microprocessor shortages, but ARC expects growth to accelerate with increasing demand for EVs. Demand from the mining, buildings and water/wastewater industries has also improved. Capital expenditures for the process industries have exceed pre-COVID-19 levels, but haven’t approached the high levels experienced before the commodity price plunge in 2016.

Top 50 N. American Automation Vendors

2021 N. American revenue (US$ millions)Impact of the war in Ukraine

The final impact of the war in Ukraine on automation markets is uncertain, but it’s caused soaring commodity prices and raw-material costs. The Russian automation market, which accounts for about 2-3% percent of the global automation marketplace, has essentially collapsed and turned into a “grey market.” Russia has cut off most of the gas flowing through the Nord Stream I pipeline, leaving many in Europe to wonder how they’ll stay warm this winter. This has left the European Union and the rest of Europe scrambling to accelerate their energy transition programs and reduce their dependence on fossil fuels. The recently announced REPower EU Plan aims to increase energy efficiency, diversify supplies, and accelerate the overall transition from fossil fuels to sustainable forms of power such as wind and solar. This is all going to require significant investment in automation and controls.

Investment transitions from hardware to software

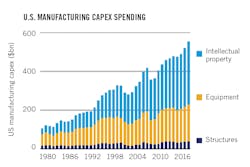

The manufacturing industry has always been asset intensive, but there’s clearly a huge shift in capital expenditure (CapEx) spending on intellectual property versus equipment and structures in the manufacturing sector, and much of this intellectual property comes in the form of software investments. While hardware outperformed software during the 2021 recovery, suppliers continue to invest in more software offerings either organically or via acquisition. The software business is more resilient, with subscription-based software-as-a-service (SaaS) and cloud-based offerings increasing across the entire automation market. ARC sees demand for both industrial software and services to continue as companies continue to invest in digitization initiatives for things like remote maintenance and operations, asset optimization, energy management, and other applications that incorporate analytics, AI and machine learning. Digitization can’t be successful without the right investments in software (Figure 1).

Increased investment in software isn’t just on the end-user side. Industrial suppliers are investing more than ever in software companies, with a huge jump in transaction volume starting around 2012 and continuously accelerating through 2021. There have been dozens of software acquisitions between 2019 and 2021 by most of the major automation and industrial suppliers, but there is still progress to be made. The oil and gas industry in particular has a long way to go before its overall investments in software approach the same level as those in the rest of the manufacturing sector. Intellectual property investment as a percent of revenue still lags significantly for the oil and gas industry as well.

Top 50 Global Automation Vendors

2021 Worldwide Revenue (US$ millions)Shift to industrial edge, cloud and 5G accelerates

With increased investment in software comes accelerating adoption of industrial edge and cloud computing. However, as we’ve been reporting for several years at ARC, the edge is of utmost importance for industrial applications. All cloud-based solutions for analytics, machine learning, new service-oriented revenue streams and other applications require data from assets, processes, personnel, and automation and control equipment resident at the edge. Edge devices play a critical role in supporting the operations technology (OT) environment by providing integration with, and insulation from, higher levels of the architecture. This is manifested by support for northbound and southbound connectivity and OT-friendly visualization and security.

Industrial IoT (IIoT) gateways and routers evolved from their traditional role in hardware-based, serial-to-Ethernet conversion to platforms for IT/OT convergence, edge-to-cloud integration and edge computing. In the future, this position will be threatened with fewer opportunities for retrofits and as thick, edge-compute devices, such as IPCs and edge servers, and intelligent endpoints incorporate edge functions.

In addition, the low latency, high data rates and massive capacity of 5G wireless promises to free connectivity from the limitations of wired infrastructure, accelerate adoption of artificial intelligence/machine learning (AI/ML), augmented reality/virtual reality (AR/VR), edge computing and mobility, and enable truly autonomous robotics, logistics and other disruptive applications. 5G coupled with multi-access, edge computing (MEC) is poised to enable these capabilities relative to Wi-Fi, 4G LTE or other wireless alternatives due to its broader coverage, maximum throughput, low latency regardless of network load, and ability to meet the future-proof requirements of industrial environments.

TSN, SPE, APL push Ethernet further into automation

Performance and reliability in demanding environments remain the hallmarks of industrial networking. Along with the overall trend toward IT/OT convergence, Ethernet continues to benefit from its status as a standard IEEE technology and associated ongoing performance improvements. Recent improvements to this end include standardization of Time-Sensitive Networking (TSN, IEEE 802.1Q), Single-Pair Ethernet (SPE, IEEE 802.3cg-2019) and Advanced Physical Layer (APL, an adaption of the IEEE 10BASE-T1L standard optimized for the process industry). This is in addition to the ongoing increases in bandwidth, port density, availability of higher Power over Ethernet (PoE) wattage, expansion of available form factors and other improvements.

Adoption of SPE and APL will ultimately drive industrial Ethernet further down to the field level, and contribute to industrial Ethernet’s ongoing descent in the architecture, while TSN standardization promises to bring real-time determinism to standard Ethernet. At issue is how long it takes for these new technologies to exert their impact, particularly as standardization of the important industrial automation profile needed for TSN implementation in industry lingers on and available new versus retrofit installations is limited.

Toward sustainability-led recovery

Sustainability issues are taking center stage at most end user companies. In oil and gas and refining, for example, sustainability is reducing staffing in traditional installations like offshore platforms and increasing investment in flaring reduction. Sustainability suddenly seems to be all anyone is talking about on both the vendor and end user sides.

However, sustainability goes beyond simple net zero emissions; it encompasses health, safety and environment (HSE) and environmental, social and governance (ESG). The drive to sustainability also encompasses the mass energy transition currently happening, both from the perspective of renewable power generation, as well as by microgrids, battery storage and more. Even oil and gas companies are making their operations more sustainable as they increasingly electrify assets and facilities. Likewise, green energy and sustainability will drive the automotive industry with a major demand for EVs from developed and developing nations.

How sustainability impacts automation spending

Sustainability initiatives can reduce costs, improve efficiency, reduce energy consumption and waste and improve safety. While companies in all markets are wrestling with sustainability and energy-related issues, industrial firms are under intense scrutiny due to their asset-heavy, energy-intensive profiles. For example, companies in electricity production and industrial segments account for nearly 50% of all greenhouse gas emissions in the U.S., according to the U.S. Environmental Protection Agency (EPA). The largest single sector greenhouse gas (GHG) producer is transportation at 29%, and it’s overwhelmingly powered by the fossil fuels produced by the oil and gas industry. Aside from a few variants, the global picture is similar.

Specifically, three industrial pillars—manufacturing, utilities and oil and gas—are at the center of global energy transition and sustainability efforts. If these segments don’t transform from their current role in the market, other efforts worldwide will ultimately be unsuccessful. When examining the challenges each faces, there are considerable nuanced similarities and differences. Also, there are dependencies across the three and even the potential for competitive conflict. Areas where ARC sees increased investment that are directly tied to sustainability initiatives include:

- Reduction of labor—automating processes and procedures (ISA 106), workforce optimization, advanced approaches to maintenance and worker training with AR/VR.

- Net-zero emissions—includes emissions, flaring, energy and carbon-intensity reduction.

- Worker and process safety—reducing incidents and spills, and reducing releases of hazardous materials to improve physical and process safety.

- Carbon capture and storage (CCS)—includes investing in plants and processes for CCS, including distribution networks and pipelines.

- Low-carbon electricity and renewables—wind, solar, hydrogen, EVs, energy service contracts.

- Circular economy—largely centers on recycling, particularly plastics, as well as reducing waste, water use and waste in decommissioning processes.

Sustainability and digitization

Adopting a digital transformation philosophy will be essential to achieving many of the goals outlined in corporate sustainability initiatives. Many technologies that support digital transformation can address sustainability issues and use cases. ML and other forms of AI are good examples. However, the way these digital solutions can be delivered makes it difficult to define the key technologies and software for sustainability and ESG goals.

In addition to the array of delivery mechanisms, these solutions can range from narrow to broad, further complicating the identification of core technologies for sustainability and ESG. To provide a framework for considering technologies to support sustainability and ESG strategies, it’s instead helpful to identify the classes of functional capabilities likely to be required, which include:

- Data management—a central capability of digital transformation, ownership or access to data management lifecycle tools will be critical to sustainability. These capabilities will support a range of competencies required, such as analytics, reporting, auditing, sourcing, workflow, etc.

- Visualization and transparency—as new data is identified as critical to sustainability performance, it must be capable of visualizing internal, external and combined sources. Also, data must be visualized for multiple roles, also internally and externally, particularly as companies must share data upstream to customers engaged in their own sustainability programs. These include cloud platforms for IT.

- Financial modeling—a key to uptake of sustainability initiatives is the capacity to prove they provide financial net benefits. This requires new modeling of inputs, outputs, resources and new outcome scenarios A set of economic skills, supported by specific applications, will be needed to provide this modeling.

- Artificial Intelligence—AI will be indispensable. As the data net of necessary data widens related to sustainability, only AI can keep up with the inherently growing volume and speed. AI will be useful in assisting in dynamic decision prioritization and operational automation required to maintain correct operational performance.

- Business process execution—companies will use this technology to ensure that required actions are taken, throughout various departments and organizations, to ensure that established targets and goals are met. This business process execution lifecycle will increasingly rely on automation.

- Emissions management and infrastructure optimization—these applications are already in wide use because they’re the most evident opportunity to improve sustainability performance across buildings, assets, fleets, etc. These are and will continue to rely heavily on AI.

- Performance auditing and reporting—though this class of technologies could also be considered part of data management and visualization, they’ll have a specific role relative to changing requirements and frameworks that will be established to support auditing and reporting. Emerging ESG platforms are examples of this class. In some instances, they’ll also need to cover circular economy concepts like sustainable product design, services and end-of-life disposal.

It should be made clear that using these technologies implies widespread use of core digital transformation technologies, such as IoT, connectivity application programming interfaces (API), sensors and others.

Achieving a sustainable industrial future requires transformational thinking and a digitally skilled workforce, together with three core elements—next-generation automation, software and analytics, and a clear focus on energy optimization. Together, the three elements of this sustainability triad deliver positive outcomes that are greater than the sum of each part.

Automation unlocks production sustainability by optimizing process, energy and resource use, cutting operating costs, and eliminating avoidable safety issues. Software-centric automation built on open standards can boost interoperability and digital collaboration, allowing industries to bring products to market sooner, increase competitiveness and turn IoT data into bottom-line value.

About the authors

Larry O'Brien, VP of research; Chantal Polsonetti, VP of advisory services; and Mike Guilfoyle, VP, who leads a team that researches energy transition and sustainability, are all of ARC Advisory Group, and can be reached via Larry at [email protected]